Are you 55 years old and recently received a lump sum of ₹50 lakh from a past investment? If yes congratulations! You are in a great position to plan your financial future. But with falling bank interest rates and a volatile stock market you might be wondering Where should I invest this money safely to grow it over the next five years?

Understand Your Financial Goals First

Before investing it’s important to ask yourself:

- Do you need monthly income from this money?

- Can you leave the money untouched for 5 years?

- Do you want safety or are you open to some risk for higher returns?

Since you are 55 the focus should be on safety, steady income and some growth. Let’s explore how to divide your ₹50 lakh for these goals.

1. Fixed Deposits (FDs) – Safe and Simple

Ideal Allocation: ₹10 lakh

FDs are one of the safest investment options in India. Even though interest rates have gone down senior citizens (those above 60) still get higher rates. Since you are 55 now you will qualify for higher rates in just 5 years.

Current FD interest rates: Around 6.5% to 7.5% per year (for 5 year tenure).

Pros:

- Capital is safe.

- Fixed returns.

- Easy to manage.

Cons:

- Returns may not beat inflation.

- Taxable interest income.

Tip: Spread your FDs across 2–3 banks for safety and better flexibility.

2. Senior Citizens Savings Scheme (SCSS)

Ideal Allocation: ₹15 lakh (after you turn 60)

The SCSS is one of the best government backed schemes for people above 60. But since you are 55 now you can plan to invest in it once you turn 60. It offers high interest and safety.

Current interest rate (2025): Around 8.2% per year (quarterly payout).

Pros:

- Very safe (government scheme).

- High interest.

- Regular income every 3 months.

Cons:

- Only available after age 60.

- Lock-in period of 5 years.

What to do now: Keep some money in short term FDs or debt funds so that it is ready to move into SCSS when you become eligible.

3. Debt Mutual Funds – Better Than FDs in Some Cases

Ideal Allocation: ₹10–15 lakh

Debt mutual funds invest in bonds and government securities. They are less risky than equity funds and can give slightly better post-tax returns than FDs especially if you hold them for 3+ years.

Types to consider:

- Short duration debt funds

- Corporate bond funds

- Banking and PSU debt funds

Expected return: 6% to 7.5% per year

Pros:

- More tax efficient than FDs (if held for 3+ years)

- Good for medium term goals

Cons:

- Slightly more risky than FDs

- Returns are not guaranteed

4. Monthly Income Plan (MIP) or Balanced Advantage Funds

Ideal Allocation: ₹5–10 lakh

Balanced Advantage Funds (BAFs) or Conservative Hybrid Funds offer a mix of debt and limited equity. They are good for someone who wants low risk with some growth. You can also set up a Systematic Withdrawal Plan (SWP) for monthly income.

Expected return: 7% to 9% per year (depending on market conditions)

Pros:

- Some exposure to equity for growth

- Regular income via SWP

- Less volatile than full equity funds

Cons:

- Not fully risk free

- Returns may vary

5. Post Office Monthly Income Scheme (POMIS)

Ideal Allocation: ₹9 lakh (₹4.5 lakh per individual)

If you want steady monthly income POMIS is a good and safe option. The limit is ₹9 lakh for joint accounts.

Current interest rate: About 7.4% per year (paid monthly)

Pros:

- Safe (government backed)

- Regular income

- Low risk

Cons:

- Income is taxable

- Maximum investment limit

6. Keep Some Cash in Liquid Funds or Bank

Ideal Allocation: ₹1–2 lakh

Always keep some money handy for emergencies. Liquid mutual funds or savings accounts can be used for this purpose. While they don’t give high returns they offer quick access to cash when needed.

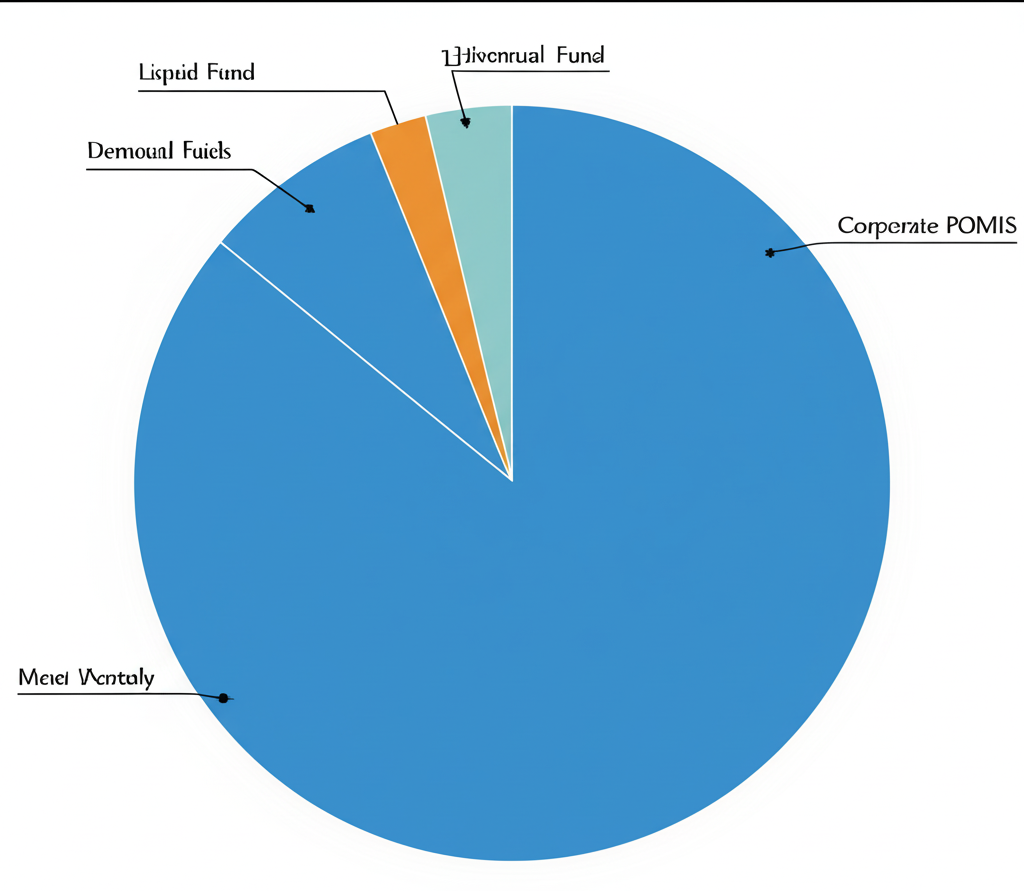

Sample Portfolio for ₹50 Lakh Investment (2025–2030)

| Investment Option | Amount (₹) |

|---|---|

| Fixed Deposits (varied tenures) | ₹10 lakh |

| Debt Mutual Funds | ₹10 lakh |

| Post Office Monthly Income Scheme | ₹9 lakh |

| Balanced Advantage/Hybrid Funds | ₹6 lakh |

| SCSS (after age 60) | ₹15 lakh |

| Liquid Fund/Emergency Cash | ₹1 lakh |

| Total | ₹51 lakh* |

(*Slightly above ₹50 lakh to give flexibility. You can adjust based on personal comfort.)

Key Tips for Safer Investment at Age 55

- Don’t put all money in one place. Diversification reduces risk.

- Review your investments once a year.

- Avoid high-risk investments like direct equity or crypto.

- Use a registered financial advisor if you’re unsure.

Final Thoughts

At age 55 the goal should be to protect your money while still earning better returns than a savings account. A smart mix of FDs, debt funds, government schemes and hybrid funds can help you grow your wealth safely over the next five years.

Always invest based on your comfort level and financial goals. With careful planning your ₹50 lakh can give you peace of mind, regular income and longterm growth.