In recent days global financial markets have faced increased volatility. The main reason? Renewed trade tensions between the United States and other major economies. President Donald Trump’s latest announcements about new tariffs have made investors nervous. These uncertainties are creating strong ripples across U.S. stock markets and other global exchanges.

What Are Trade Tensions?

Trade tensions happen when countries disagree about how they exchange goods and services. This often involves tariffs which are taxes on imports or exports. When one country imposes tariffs it makes foreign products more expensive. This can lead to trade wars where countries keep raising tariffs on each other.

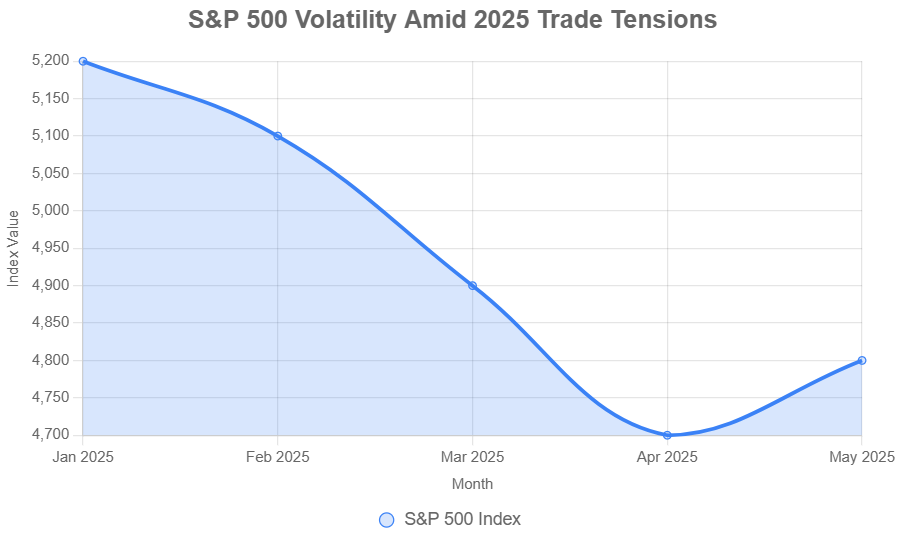

Trade tensions between the U.S. and China have been ongoing for several years. Recently President Trump raised the stakes by threatening new tariffs on imported goods. These announcements have unsettled investors causing major stock indexes to swing sharply.

Market Reaction to the Tariff Threats

The U.S. stock markets were quick to respond. The S&P 500 which tracks 500 of the biggest companies in the U.S., closed nearly flat after a rollercoaster day of trading. The Nasdaq which is heavily focused on tech stocks fell. Investors are worried that tariffs could hurt companies that depend on global supply chains.

For example, tech companies often rely on parts from many countries. If tariffs raise the cost of these parts, profits may fall. That’s why markets react so strongly to trade news.

Why Investors Are Nervous

Investors hate uncertainty. And trade tensions create a lot of it. When it’s unclear how international trade will work businesses can’t plan properly. They may delay investments, stop hiring or reduce spending. All of these things slow down the economy.

Investors are also worried about:

- Higher costs: Tariffs increase the price of goods. This can lead to inflation which hurts both consumers and companies.

- Slower growth: If global trade shrinks economies grow more slowly.

- Lower earnings: Companies may earn less if they face higher costs or fewer sales.

Impact on Different Markets

- U.S. Markets: The immediate effect has been increased volatility. The Dow Jones, S&P 500 and Nasdaq are all swinging between gains and losses. Investors are trying to figure out what will happen next.

- Asian Markets: Since many Asian countries depend on exports trade tensions can hit them hard. Stock indexes in China, Japan and South Korea have also fallen in response to U.S. tariffs.

- European Markets: Europe is also feeling the pressure. Although the continent is not directly involved in the U.S.-China trade conflict global uncertainty affects all major economies.

What This Means for the Global Economy

Trade tensions can reduce global economic growth. When major economies like the U.S. and China fight over trade other countries suffer too. Global supply chains are complex. A problem in one country can affect companies worldwide.

According to economists prolonged trade wars could push some countries into recession. The International Monetary Fund (IMF) has already warned that rising tariffs could cost the global economy billions of dollars.

How This Affects You

Even if you are not a stock market investor trade tensions can still impact your life:

- Higher Prices: Everyday items like electronics or household goods could get more expensive.

- Job Market: Companies affected by tariffs might slow down hiring or cut jobs.

- Investment Accounts: If you have a retirement fund or other investments their value could go up and down more sharply.

What Investors Can Do

In times of market volatility it’s important not to panic. Here are a few tips for investors:

- Stay informed: Follow reliable news sources and understand what’s driving the markets.

- Diversify: Don’t put all your money in one type of asset or region. A mix of stocks, bonds and international investments can reduce risk.

- Think long-term: Markets always face ups and downs. Longterm investors often ride out volatility and come out ahead.

What to Expect Going Forward

No one knows exactly how the current trade tensions will end. It depends on many factors including political decisions, economic data and negotiations between countries. But most analysts agree that as long as there is uncertainty markets will remain volatile.

Many investors are now watching closely for:

- Statements from the U.S. government: More tariffs or trade talks could swing the market either way.

- Earnings reports: If companies report lower profits due to tariffs stock prices may fall further.

- Global responses: Other countries may retaliate adding more uncertainty to the situation.

Final Thoughts

The recent spike in market volatility shows how sensitive the global economy is to trade policy. President Trump’s tariff threats have brought trade concerns back into the spotlight. Investors are rightly worried and their reactions are showing up in stock prices.

It’s a reminder that politics and economics are closely connected. While it’s hard to predict what will happen next staying informed and prepared can help individuals and investors navigate uncertain times.