Nasdaq, S&P 500 and Dow near record highs as Nvidia crosses $4 trillion market cap

Introduction

The U.S. stock market is once again making headlines. On Wall Street, the major indexes—Dow Jones, S&P 500 and Nasdaq—are moving toward record highs. This rise is being powered by strong performance from technology stocks especially Nvidia which recently crossed a massive $4 trillion market value. This is a big moment for investors and the overall economy.

What’s Happening on Wall Street?

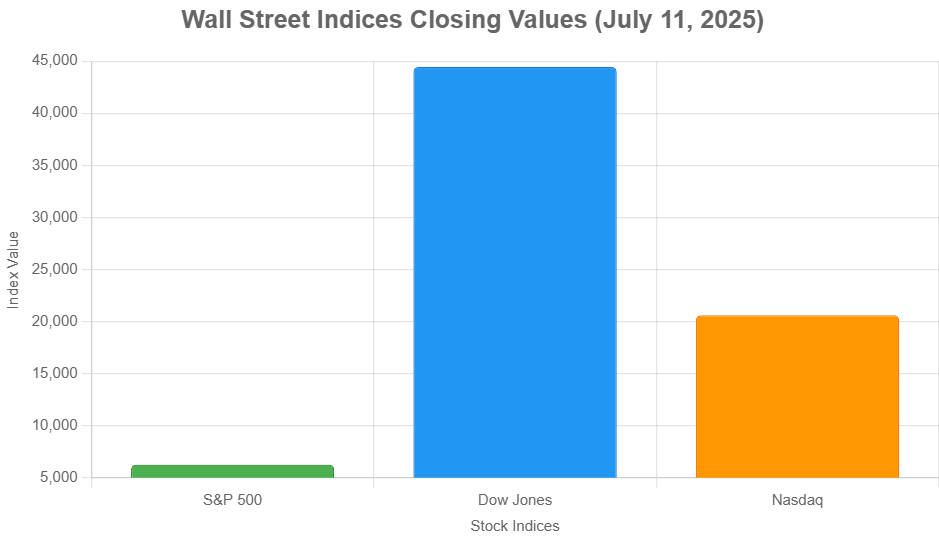

Wall Street is seeing positive momentum. The Dow Jones Industrial Average, S&P 500 and the Nasdaq Composite are all rising steadily. These three indexes are important because they show the overall health of the U.S. stock market.

- Dow Jones tracks 30 large American companies.

- S&P 500 follows 500 of the biggest companies in the U.S.

- Nasdaq focuses on technology and growth-oriented companies.

This week, all three indexes are edging closer to their all-time highs a sign that investors feel confident about the future.

Tech Stocks Are Driving the Rally

The biggest reason for the market’s upward movement is the strong performance of technology stocks. Companies like Apple, Microsoft, Amazon and especially Nvidia are leading the charge.

Out of all the tech companies Nvidia is the star of the show.

Nvidia Hits $4 Trillion Market Cap

Nvidia, a company known for making graphics chips and powering artificial intelligence (AI) systems, has reached an incredible milestone—a $4 trillion market capitalization. This means the total value of all Nvidia’s shares is now over $4 trillion making it one of the most valuable companies in the world alongside Apple and Microsoft.

Why is Nvidia Doing So Well?

There are a few key reasons:

- Boom in Artificial Intelligence

Nvidia’s chips are essential for powering AI tools like ChatGPT, image generators and robotics. As more companies invest in AI they buy more Nvidia products. - Strong Financial Results

Nvidia has been reporting strong profits and high revenue growth which boosts investor confidence. - Future Growth Potential

Investors believe Nvidia has a bright future. Its products are important for many industries—cloud computing, gaming, self-driving cars and AI.

How Other Tech Giants Are Performing

It’s not just Nvidia. Other tech giants are also doing well:

- Apple is seeing gains due to steady demand for its products and services.

- Microsoft continues to benefit from cloud computing and AI investments.

- Amazon is growing with the help of its e-commerce business and Amazon Web Services (AWS).

- Meta (Facebook) and Alphabet (Google) are also gaining as ad spending picks up.

Together, these companies make up a large portion of the S&P 500 and Nasdaq indexes, so when they rise, the whole market goes up.

Investor Optimism is Growing

There are a few reasons why investors are feeling more positive:

- Low Interest Rate Expectations

The U.S. Federal Reserve has signaled that it may cut interest rates later this year if inflation stays under control. Lower rates usually boost stock prices because borrowing becomes cheaper for companies and consumers. - Strong Economic Data

Recent reports show that the U.S. economy is still growing with low unemployment and rising consumer confidence. - AI Boom

Investors are excited about how artificial intelligence will transform industries and create new business opportunities. This is boosting demand for tech stocks.

Risks Still Remain

Even though the market is rising there are still some risks:

- Inflation could still go up, forcing the Fed to raise rates again.

- Geopolitical tensions like the U.S.-China relationship or conflicts in Europe and the Middle East, could hurt investor sentiment.

- Valuation concerns: Some experts worry that tech stocks are becoming too expensive, especially if growth slows down.

What Does This Mean for Indian Investors?

If you’re an Indian investor this Wall Street rally can affect you in several ways:

- Global Mutual Funds

If you invest in U.S. or international mutual funds, your portfolio may benefit from the rising U.S. market. - Indian IT & Tech Stocks

Positive tech sentiment in the U.S. can lift Indian IT stocks like Infosys, TCS, and Wipro, as they earn a large part of their revenue from the U.S. - Currency Movements

A strong U.S. economy could impact the rupee-dollar exchange rate affecting import/export businesses and foreign investment in India.

What Should You Do as an Investor?

If you’re wondering what steps to take, here are a few tips:

- Diversify your investments. Don’t put all your money in one sector or stock.

- Watch global trends. Events in the U.S. often impact Indian markets too.

- Stay long-term focused. Market ups and downs are normal. Don’t make decisions based on short-term moves.

- Consider U.S. exposure. If you believe in the AI and tech growth story, you can look into mutual funds or ETFs with U.S. exposure.

Conclusion

Wall Street is on the rise and tech stocks especially Nvidia are leading the way. With Nvidia crossing the $4 trillion mark and other tech giants gaining the market is nearing record highs. While this brings opportunities for investors it also comes with some risks.

Whether you are investing in India or globally staying informed and thinking long term is the best strategy.