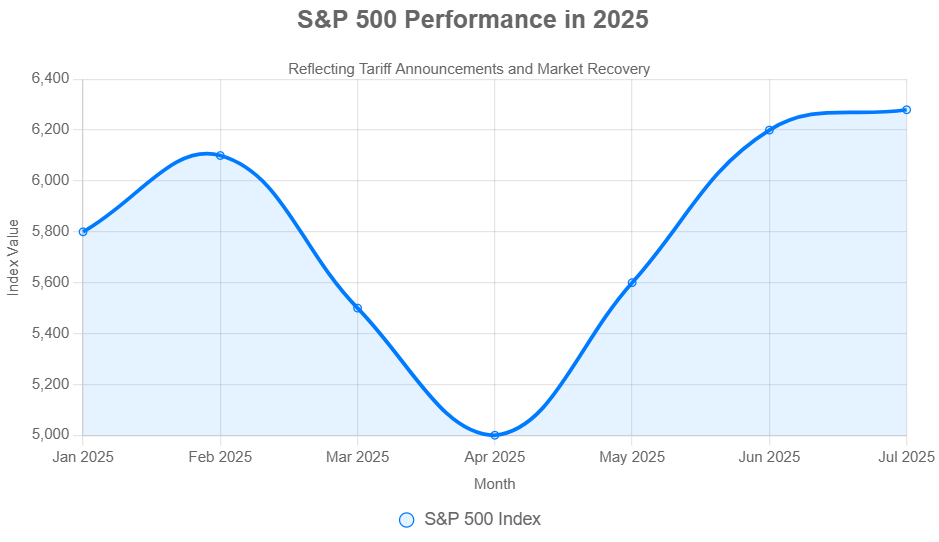

The US stock markets had a bumpy ride in the week ending July 11, 2025. After hitting record highs earlier this year the markets pulled back slightly leaving investors concerned. So what’s going on?

1. Markets Faced Volatility This Week

Volatility means that the market was not stable. Stock prices were going up and down quickly and many investors were unsure of what to expect next.

This week major stock indexes like the Dow Jones, S&P 500 and Nasdaq dropped from their highest levels. This decline was caused by several reasons including:

- Growing trade tensions (new tariffs announced)

- Uncertainty in the economy

- Upcoming second-quarter earnings season (Q2)

2. What Are Tariffs and Why Do They Matter?

A tariff is a tax that one country places on goods coming from another country. In 2025 the US has introduced or proposed new tariffs on goods from countries like China, Mexico and Europe. These tariffs are meant to protect American businesses but they can also increase prices for consumers and lead to trade wars.

When countries fight over trade it creates fear in the stock market. Companies may earn less money supply chains can get disrupted and the global economy can slow down.

This week the fear of more tariffs made investors sell their shares in companies that rely on global trade especially technology, consumer and industrial companies.

3. Q2 Earnings Season Is Around the Corner

Every quarter companies report their earnings how much money they made or lost. The Q2 earnings season (April to June) is starting soon. Investors are waiting to see if companies did well or faced challenges.

Since interest rates are high and inflation is still an issue many investors expect company profits to be lower than usual. That’s why some people are choosing to stay away from the stock market for now they are waiting for more clarity.

4. Short Interest is Rising: What Does That Mean?

Here’s another important point short interest in US stocks is growing.

Short interest means how much money investors are betting that stocks will fall. In 2025 short interest has gone up by $139 billion.

Let’s look at the sectors with the highest short interest:

- Technology Stocks: $105 billion

- Consumer Discretionary Stocks: $41 billion

- Industrial Stocks: $37 billion

This means many investors think these types of companies will lose value in the near future. That’s a sign of caution people are worried about future earnings and business performance.

5. Why Tech Stocks Are Under Pressure

Technology companies have been the biggest stars of the stock market in recent years. Giants like Apple, Nvidia, Google and Microsoft have helped drive the market higher.

But now these same companies are facing pressure because:

- They sell globally so tariffs can hurt them

- They have high valuations which means they are expensive

- Interest rates are high which affects future profits

As a result many investors are selling tech stocks or betting against them. That’s why short interest is so high in this sector.

6. Consumer Discretionary Stocks Are Also Falling

Consumer discretionary companies are businesses that sell non-essential items like cars, electronics, clothes or luxury goods. When people have extra money they spend more on these products. When the economy slows down they spend less.

Right now many consumers are feeling the pressure of inflation, high interest rates and rising debt. This is making investors cautious about these stocks.

That’s why companies like Amazon, Nike and Tesla are seeing increased short interest. Investors think they might struggle in the short term.

7. Industrial Stocks Are Feeling the Heat Too

Industrial companies build machines, airplanes, buildings and more. They depend heavily on the global economy, exports and trade.

Because of the uncertainty caused by tariffs and slowing demand industrial stocks are underperforming too. This includes companies like Caterpillar, GE and Boeing.

8. What Should Investors Do Now?

If you are an investor you may be asking: Should I stay invested sell my stocks or wait?

Here are a few simple tips:

a) Don’t Panic

Market ups and downs are normal. Volatility happens especially during uncertain times. It does not mean you have to sell everything.

b) Focus on Long-Term Goals

If you’re investing for retirement or long-term wealth short-term changes should not scare you. Stay focused on your goals.

c) Diversify Your Portfolio

Don’t put all your money into one sector like tech. Spread your investments across different sectors and asset classes like mutual funds, gold, real estate, etc.

d) Look for Opportunities

Sometimes when markets fall, good companies become cheaper. That can be a chance to buy quality stocks at a discount.

e) Stay Informed

Keep an eye on economic news, earnings reports and market trends. But don’t react emotionally to every headline.

Final Thoughts

The US financial markets saw a pullback this week because of tariff worries economic uncertainty and the upcoming earnings season. Rising short interest shows that many investors are cautious especially about tech, consumer and industrial stocks.

But remember: smart investing is not about timing the market it’s about time in the market. Stick to your strategy, keep learning and invest wisely.