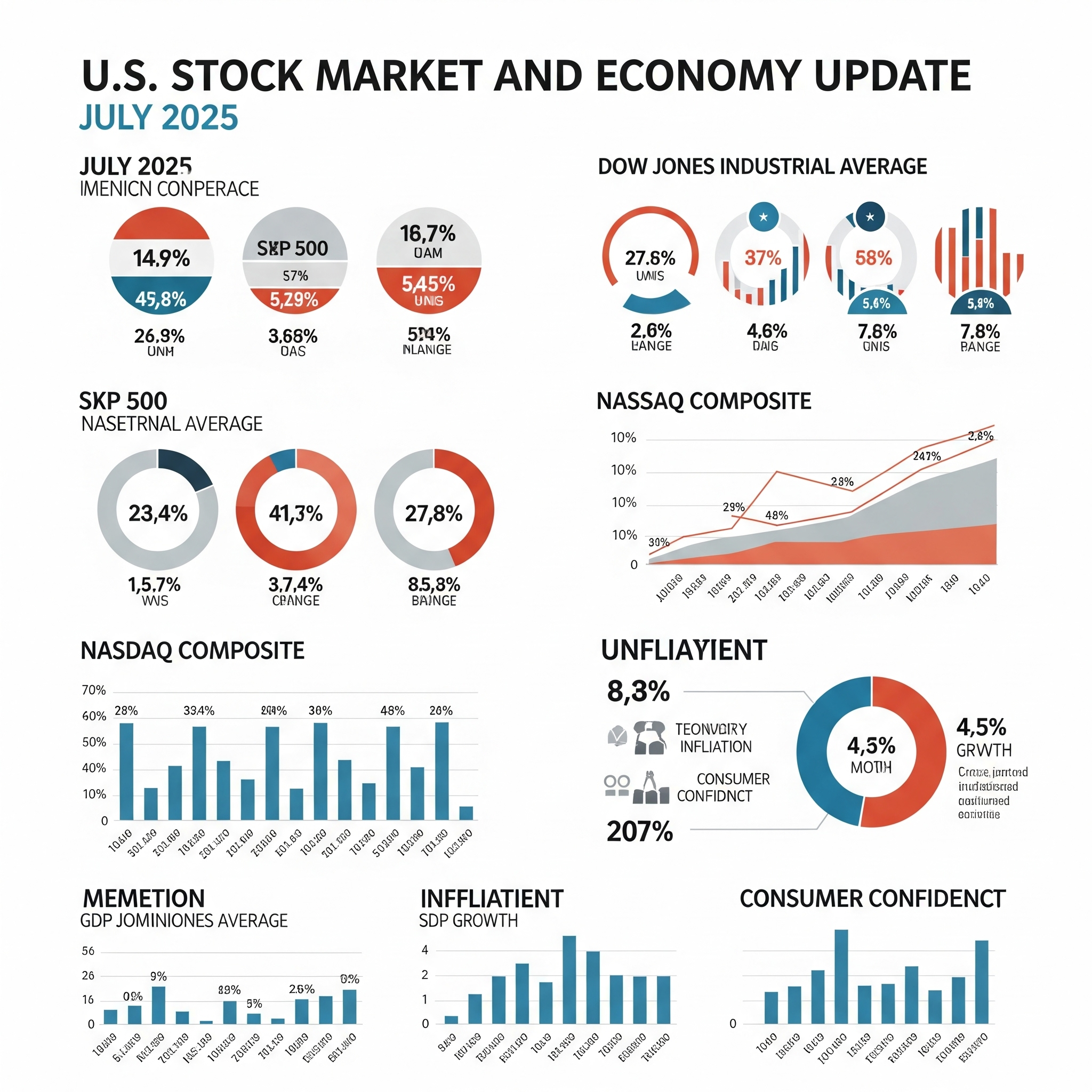

The U.S. stock market is facing some ups and downs this week. Stock futures for the major indexes S&P 500 Dow Jones Industrial Average and Nasdaq 100 dipped slightly. This means investors are being cautious and prices may fall a bit when the market opens.

But it’s not all bad news. The U.S. economy is still showing signs of strength. In the latest job report, the country added 147,000 new jobs and the unemployment rate is holding steady at 4.1%. This tells us that many people are still finding work and companies are still hiring.

What Are Stock Futures and Why Do They Matter?

Stock futures are contracts that predict what stock prices might do in the future. Investors use them to guess whether the stock market will go up or down. If futures are down like they are now it means investors think stock prices might fall a little.

This week all three major U.S. indexes are slightly down:

- S&P 500 – Tracks 500 of the largest companies in the U.S.

- Dow Jones – Tracks 30 major U.S. companies like Apple, Boeing and Coca-Cola.

- Nasdaq 100 – Focuses mostly on tech companies like Google, Microsoft and Amazon.

A dip in these indexes means investors are being cautious.

Why Are Investors Worried? Tariff Tensions

One big reason is tariff threats. The U.S. government is considering adding new tariffs or taxes on goods from other countries. This is part of a bigger trade strategy but it often leads to tension with trading partners like China, the European Union or Mexico.

When tariffs are raised:

- Goods from other countries become more expensive.

- American companies that rely on those goods may face higher costs.

- Foreign countries may also add their own tariffs on American products in return.

This can hurt businesses and make things more expensive for consumers. That’s why investors are nervous. They worry that tariffs could slow down business growth or even lead to a trade war.

But the Economy Is Still Strong

Despite the worry in the stock market the U.S. economy is still growing steadily.

Job Growth

In the latest report the U.S. economy added 147,000 new jobs. That means more people are working, earning money and spending it. This helps businesses grow.

Unemployment Rate

The unemployment rate is 4.1% which is considered very healthy. A low unemployment rate means most people who want jobs can find one. This also gives workers more confidence to spend money, travel, or invest.

What This Means for You

Whether you are an investor, a worker or someone planning your finances here’s what to keep in mind:

1. Stock Market May Be Volatile

Because of tariff tensions and global uncertainty markets might go up and down more than usual. Don’t panic if you see short-term drops it’s common during trade discussions.

2. Job Market Looks Good

If you are looking for a job or thinking about switching careers now might be a good time. Companies are still hiring and wages could rise if the job market stays strong.

3. Prices Could Rise

Tariffs often lead to higher prices for goods like electronics, food, or clothes. This can hurt consumers if the trade tensions last too long.

4. Keep an Eye on Inflation

When prices go up too fast it’s called inflation. The Federal Reserve might raise interest rates to control inflation which can affect loans, mortgages and savings interest.

What’s Next?

Here’s what we might see in the coming weeks:

- More trade talks and headlines about tariffs. These will affect how investors feel about the market.

- Updates from the Federal Reserve. They will decide whether to change interest rates based on inflation and job growth.

- Earnings season is coming. Big companies will report their profits soon giving us a better idea of how businesses are doing.

Final Thoughts

The U.S. stock market is feeling a little shaky due to talk of new tariffs but the overall economy is still in good shape. Job growth is steady and the unemployment rate is low. These are strong signs that the economy is still moving forward.

For now investors are being cautious and that’s causing slight dips in the stock market. But with a strong job market and consumer spending there is still plenty of hope for growth in the months ahead.

As always it’s a good idea to stay informed keep a long-term view and avoid making big decisions based on daily headlines.