Everyone dreams of becoming financially free one day. One of the most common goals for Indians is to build a retirement fund that gives peace of mind, security and freedom. A target of ₹10 crore by the time you turn 60 may sound like a big number but with systematic investment planning (SIP) and the power of compounding it is very much possible.

What is SIP?

SIP stands for Systematic Investment Plan. It is a smart way to invest in mutual funds. Instead of putting a large amount at once you invest a fixed amount every month. This method helps you stay disciplined and benefit from rupee cost averaging and compounding over time.

Why ₹10 Crore?

With rising inflation longer lifespans and growing lifestyle costs having a ₹10 crore retirement corpus can help you live comfortably without financial stress. It ensures that you have enough money to cover:

- Monthly expenses

- Medical needs

- Travel and leisure

- Emergencies

- Supporting family

Important Factors to Consider

To know how much SIP you need to reach ₹10 crore, we must consider:

- Your current age

- Number of years left until you turn 60

- Expected return rate (usually 10%-15% annually for equity mutual funds)

- Monthly SIP amount

Let’s take different scenarios to understand better.

Case 1: You are 25 years old

Time to invest: 35 years (60 – 25)

Expected return: 12% annually

Using SIP calculator you will need to invest around:

₹10500 per month

That’s it! Just by investing ₹10500 every month for 35 years you can build ₹10 crore. This is the power of starting early.

Total investment = ₹44.1 lakh

Wealth gained = ₹9.56 crore

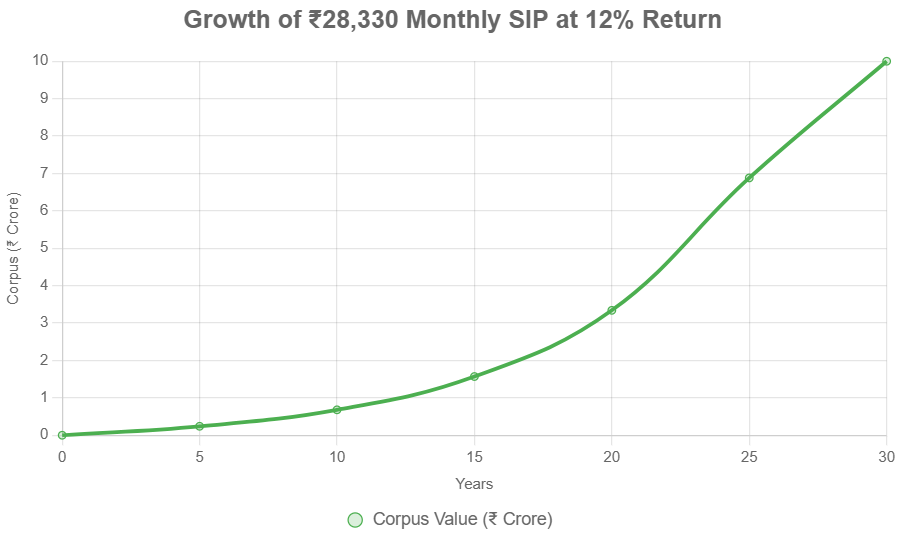

Case 2: You are 30 years old

Time to invest: 30 years

Expected return: 12%

Required SIP = ₹18500 per month

Total investment = ₹66.6 lakh

Wealth gained = ₹9.33 crore

Case 3: You are 35 years old

Time to invest: 25 years

Expected return: 12%

Required SIP = ₹33500 per month

Total investment = ₹1 crore

Wealth gained = ₹9 crore

As you can see, the later you start the more you need to invest each month.

Case 4: You are 40 years old

Time to invest: 20 years

Expected return: 12%

Required SIP = ₹61500 per month

Total investment = ₹1.48 crore

Wealth gained = ₹8.52 crore

The amount is much higher now. Delaying your investment increases the monthly burden and reduces the effect of compounding.

Why Starting Early is Better

Starting early allows more time for your money to grow. Even small amounts invested over a long time can result in big wealth. This is called the Power of Compounding your returns earn further returns over time.

Here’s a simple example:

- Invest ₹5000/month for 30 years = ₹1.76 crore

- Invest ₹10000/month for 15 years = ₹41 lakh

So even though the second person invested more each month the first person ended up with more wealth because they started early.

Where to Invest SIPs?

To reach ₹10 crore you need higher returns. That’s why equity mutual funds are a good option for long-term goals. Here are some mutual fund types:

- Large Cap Funds – Stable and low-risk

- Mid Cap Funds – Balanced growth

- Small Cap Funds – High growth, high risk

- Index Funds – Track Nifty/Sensex

- Flexi Cap Funds – Mix of all

Diversify your SIPs across 2-3 different funds to balance risk and return.

Tips to Reach ₹10 Crore

- Start Early – The earlier the better

- Stay Consistent – Never skip your SIPs

- Increase SIPs with income – Use Step-Up SIP

- Don’t Withdraw Early – Let compounding work

- Review Annually – Make changes if needed

What is Step-Up SIP?

A Step-Up SIP means increasing your SIP amount every year. For example, if your salary increases by 10%, you increase your SIP amount by 10% too.

This helps you reach your goal faster.

For example, if you start with ₹10000/month and increase it by 10% every year, you will reach ₹10 crore sooner than someone investing a fixed ₹10000/month.

Common Mistakes to Avoid

- Starting late

- Skipping SIPs during tough times

- Investing only in low-return options like FD or PPF

- Not reviewing portfolio regularly

- Expecting unrealistic returns (15-20% every year)

Final Thoughts

Reaching a ₹10 crore retirement goal is possible for almost anyone. The key is to start as early as possible, stay disciplined and invest smartly in equity mutual funds through SIPs.

If you are young even a small monthly SIP can help you become a crorepati. If you are older don’t panic—start now, invest more and consider step-up SIPs. The most important thing is to take action today.

Your future self will thank you.