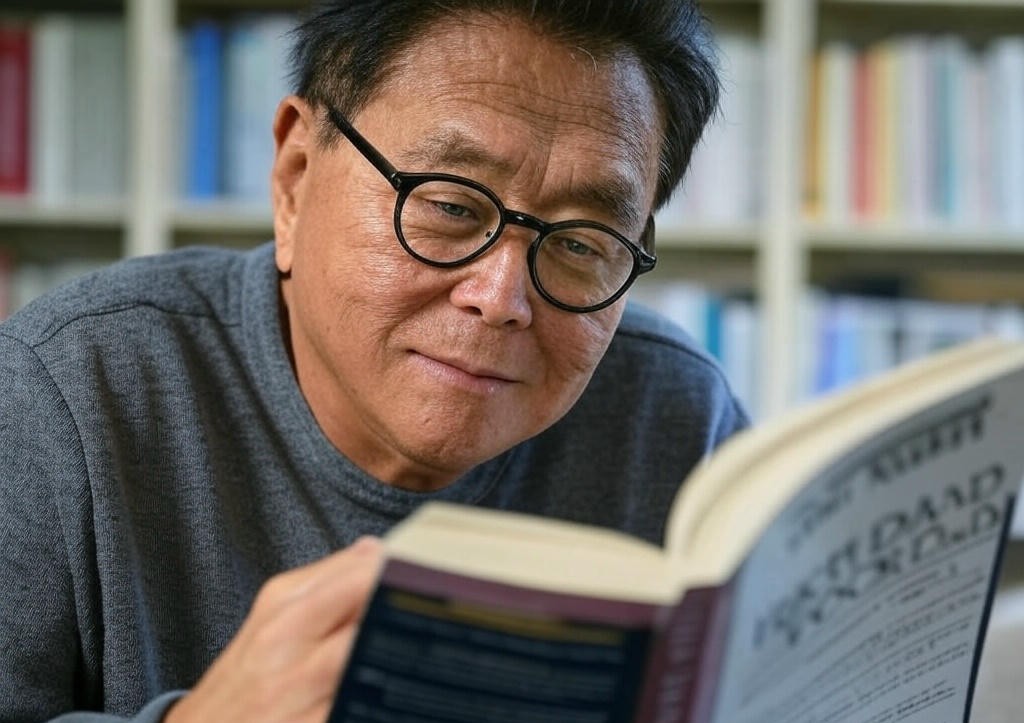

Robert Kiyosaki the famous author of Rich Dad Poor Dad recently shared a thought provoking riddle on X that has got everyone talking. The riddle asks two simple yet powerful questions: What do poor people buy too much of that keeps them poor? and What do rich people buy too much of that keeps them getting richer? These questions are not just a puzzle but a lesson in understanding how our financial choices shape our future.

The Core Idea of the Riddle

Kiyosaki’s riddle is rooted in his core philosophy from Rich Dad Poor Dad: the difference between assets and liabilities. He believes that the poor and middle class often spend their money on things that don’t help them grow financially while the rich focus on buying things that make them wealthier over time. This difference in mindset and spending habits is what separates those who struggle financially from those who achieve financial freedom.

What Do Poor People Buy Too Much Of?

According to Kiyosaki poor people tend to spend too much on liabilities. But what are liabilities? These are things that take money out of your pocket instead of putting money in. For example:

- Consumer Goods: Many people spend a lot on fancy clothes, the latest gadgets or expensive cars to look rich. These things might feel good in the moment but they lose value over time and don’t generate income.

- Debt for Non-Essentials: Taking loans or using credit cards to buy things like vacations, luxury items or big screen TVs can trap people in debt. Paying interest on these loans means even more money leaves your pocket.

- Lifestyle Expenses: Spending heavily on dining out, entertainment or keeping up with trends can drain savings. These expenses don’t build wealth and often leave people with little to invest.

Kiyosaki’s point is that poor people often prioritize looking rich over being rich. They buy things they don’t need which keeps them stuck in a cycle of earning, spending and struggling to make ends meet. For example buying a new phone every year might seem normal but that money could be saved or invested to grow over time.

What Do Rich People Buy Too Much Of?

On the other hand Kiyosaki says rich people focus on buying assets. Assets are things that put money in your pocket helping you build wealth over time. Some examples of assets include:

- Real Estate: Buying rental properties or land that can generate income or increase in value is a common strategy for the wealthy.

- Stocks and Bonds: Investing in the stock market or bonds can provide dividends or grow in value creating passive income.

- Businesses: Starting or investing in a business can generate profits and build longterm wealth.

- Precious Metals: Kiyosaki often talks about investing in gold, silver or even Bitcoin which he believes hold value better than cash.

Rich people don’t just spend their money they make their money work for them. Instead of buying a luxury car they might invest in a property that pays rent every month. Instead of splurging on designer clothes they might buy stocks that pay dividends. This mindset of investing in assets is what helps them get richer over time.

Why This Riddle Matters

Kiyosaki’s riddle is not just about money it’s about changing the way we think. Most of us are taught to work hard, earn a salary and spend on things that make life comfortable. But Kiyosaki challenges this idea. He says financial education is the key to breaking free from the “rat race” of working just to pay bills. By understanding the difference between assets and liabilities we can make smarter choices with our money.

For example imagine two people earning the same salary. One spends their money on a new car, fancy dinners and the latest phone. The other saves and invests in a small rental property. Over time the first person has nothing to show for their spending while the second person earns extra income from rent and builds wealth. This is the power of choosing assets over liabilities.

How to Apply Kiyosaki’s Lesson

You don’t need to be rich to start thinking like the rich.

- Learn About Money: Take time to understand basic financial concepts like assets, liabilities and passive income. Read books, watch videos or take free online courses on personal finance.

- Cut Unnecessary Spending: Look at your expenses and identify things you don’t need. For example can you skip buying a new phone this year and save that money instead?

- Start Small: You don’t need a lot of money to invest. Start with small investments like buying a few stocks saving for a down payment on a rental property or even investing in a low cost mutual fund.

- Avoid Bad Debt: Stay away from loans or credit card debt for things that don’t generate income. If you must borrow use it for assets like education or a business.

- Build Passive Income: Look for ways to create income streams that don’t require your constant work like investing in dividend paying stocks or renting out a property.

The Power of Financial Education

Kiyosaki’s riddle emphasizes that financial education is more important than a high salary. Many people earn a lot but stay poor because they don’t know how to manage their money. By learning to prioritize assets and reduce liabilities anyone can start building wealth no matter their income.

For example Kiyosaki often shares how he built his wealth “little by little” through disciplined investing. He didn’t start with millions—he started with small smart choices. This is encouraging because it means anyone can follow his advice even with limited resources.

Conclusion

Robert Kiyosaki’s latest riddle is a wake up call to rethink our spending and investing habits. Poor people buy too much of what they don’t need liabilities like consumer goods and non essential debt while rich people buy assets that generate income and grow their wealth. By focusing on financial education and making small, smart choices we can all start building a richer future.

The next time you are tempted to splurge on something shiny ask yourself “Is this an asset or a liability?” That simple question could be the first step toward financial freedom. So take Kiyosaki’s riddle to heart start learning about money and make your money work for you.