Are you thinking of investing Rs 17 lakh in mutual funds as a one-time lump sum investment? If yes you might be wondering how much wealth it can create for you in the future. Can it become Rs 2 crore, Rs 3 crore or even Rs 5 crore? If so how many years will it take?

💡 Power of Lump Sum Investment

Mutual funds are a popular investment option for wealth creation. They offer the benefits of professional management, diversification and potential for long term returns.

A lump sum investment means you invest a large amount at once instead of investing monthly through SIPs (Systematic Investment Plans). This can be very effective when you have a bonus inheritance or any savings parked in your bank.

One key advantage is compound growth—your investment earns returns and those returns also start earning returns over time.

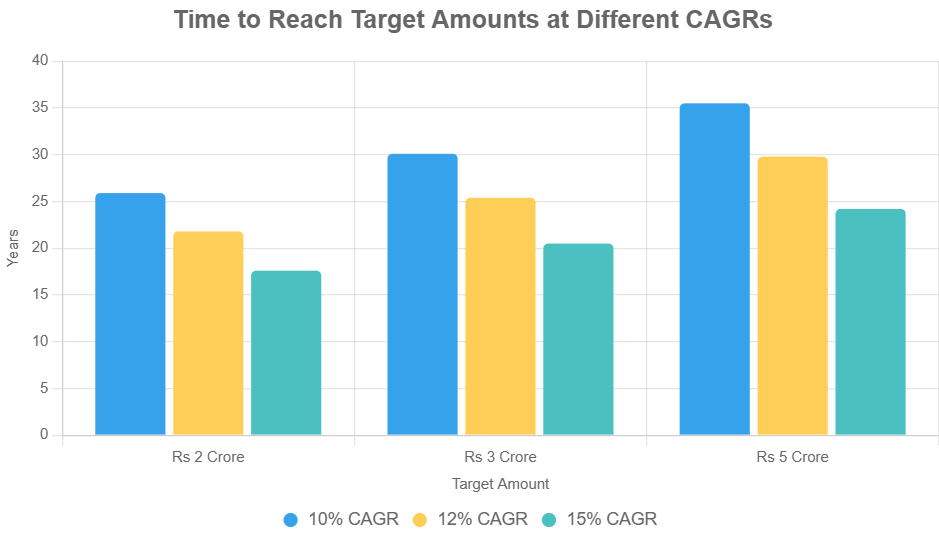

Let’s now see how a lump sum of Rs 17 lakh can grow into crores depending on your investment horizon and the average rate of return.

📊 Assumptions for Calculation

- Investment amount: Rs 17 lakh

- Investment type: Lump sum in equity mutual funds

- Expected average annual return: 12% (common for good equity funds over the long term)

- Corpus goals: Rs 2 crore, Rs 3 crore and Rs 5 crore

Let’s use the compound interest formula:

FV = PV × (1 + r)^n

Where:

- FV = Future Value (your goal, e.g., Rs 2 crore)

- PV = Present Value (Rs 17 lakh)

- r = Annual rate of return (12% or 0.12)

- n = Number of years

We will rearrange this formula to calculate how many years (n) it takes to reach the future value.

⏳ How Many Years to Reach Rs 2 Crore?

We want Rs 17 lakh to grow to Rs 2 crore.

Using a financial calculator or Excel:

arduinoCopyEditn = log(FV / PV) / log(1 + r)

n = log(20000000 / 1700000) / log(1.12)

n ≈ log(11.76) / log(1.12)

n ≈ 1.071 / 0.0492 ≈ 21.76

👉 It will take around 22 years to grow your investment to Rs 2 crore at a 12% return per annum.

⏳ How Many Years to Reach Rs 3 Crore?

For Rs 3 crore:

arduinoCopyEditn = log(30000000 / 1700000) / log(1.12)

n ≈ log(17.65) / log(1.12)

n ≈ 1.247 / 0.0492 ≈ 25.35

👉 It will take around 25.4 years to reach Rs 3 crore.

⏳ How Many Years to Reach Rs 5 Crore?

For Rs 5 crore:

arduinoCopyEditn = log(50000000 / 1700000) / log(1.12)

n ≈ log(29.41) / log(1.12)

n ≈ 1.468 / 0.0492 ≈ 29.84

👉 It will take nearly 30 years to grow Rs 17 lakh into Rs 5 crore.

📈 Summary Table

| Target Corpus | Time Required (12% Return) |

|---|---|

| Rs 2 Crore | Around 22 years |

| Rs 3 Crore | Around 25.4 years |

| Rs 5 Crore | Around 30 years |

🧠 Key Takeaways

- Start Early: The earlier you invest, the easier it becomes to reach large financial goals. Time is your greatest asset in compounding.

- Equity Funds are Powerful: Over the long term, equity mutual funds tend to outperform other asset classes like fixed deposits or gold.

- Patience Pays: Investing is not about timing the market but spending time in the market. The longer you stay invested, the higher your chances of wealth creation.

- Reinvest Gains: Don’t withdraw gains too early. Reinvesting dividends and profits can speed up compounding.

- Review Periodically: While long-term investing is ideal, review your portfolio once every 6 to 12 months to make sure it’s performing well and aligned with your goals.

🛡️ Risks to Keep in Mind

- Equity markets are volatile in the short term. But historically they have given strong returns over 10–15 years or more.

- Past performance is not guaranteed in the future. Choose good funds based on consistent performance, fund manager experience and category ranking.

- Consider consulting a SEBI-registered financial advisor before making large investments.

💬 Conclusion

A one-time investment of Rs 17 lakh in mutual funds has the power to grow into Rs 2 crore in about 22 years, Rs 3 crore in around 25 years and Rs 5 crore in roughly 30 years assuming a 12% annual return.

This shows the incredible power of compounding and patience. If you are planning your retirement or long-term wealth creation a disciplined approach with lump sum investing in mutual funds can work wonders.

Don’t wait to invest. Invest and wait – that’s the key to building wealth over time.