The global financial markets are going through a bumpy ride in 2025. From the Russian rouble’s surprising strength to rising bond yields and chatter on social media theres a lot to unpack. To understand whats driving these changes and what they might mean.

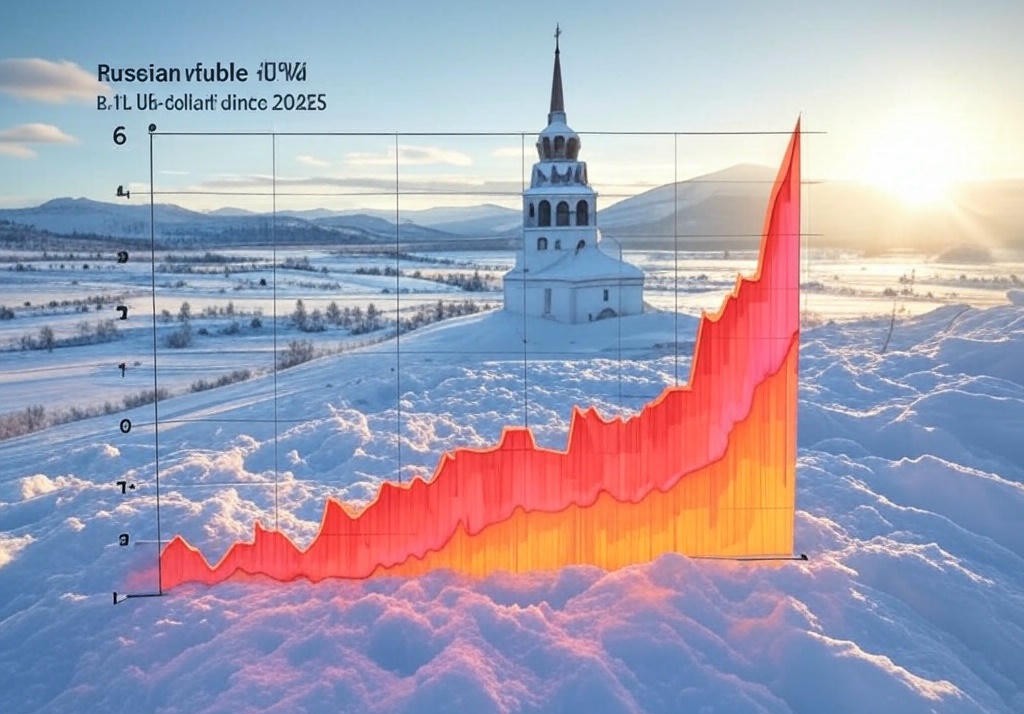

The Russian Rouble’s Big Comeback

The Russian rouble has been making headlines. It has strengthened past 81 against the US dollar a massive 40% jump since the start of 2025. Why is this happening? The answer lies in oil prices. Russia is a major oil producer and as oil prices climb the country earns more money. This boosts demand for the rouble pushing its value higher. A stronger rouble helps Russia buy goods and services from other countries more easily but it also shows how much global markets depend on energy prices.

Bond Markets Are Shaking

Bond markets are feeling the heat. Bonds are like loans that governments and companies issue to raise money. When people worry about the future they demand higher interest rates (or yields) to lend their money. Right now yields are spiking because of concerns about the US government’s growing debt and the possibility of new tariffs. Tariffs are taxes on imported goods and they can raise prices leading to inflation. When investors fear inflation they sell bonds causing yields to rise. This turbulence is making investors nervous about where to put their money.

What’s the Buzz on X?

On platforms like X people are sharing their thoughts about these market shifts. Some posts warn that the global financial system might be unstable pointing to the rouble’s rise and bond market chaos as red flags. Others think these changes are just normal ups and downs in a complex world. While these discussions are loud they don’t provide clear proof of a looming crisis. Markets are unpredictable and social media can amplify fears without solid evidence. It’s wise to dig deeper before jumping to conclusions.

Why Does This Matter?

These events affect more than just traders and bankers. A stronger rouble could change the price of goods Russia exports, like oil and gas, impacting countries that rely on them. Rising bond yields might make borrowing more expensive for governments and businesses which could slow down economic growth. For everyday people this might mean higher prices for things like fuel or groceries if inflation picks up.

What’s Next?

No one can predict exactly what will happen. Oil prices, government policies and global trade will keep shaping markets. Investors and policymakers are watching closely trying to balance risks and opportunities. For now staying informed and cautious is the best approach.

In summary the rouble’s rise and bond market turbulence reflect a world of uncertainty. While social media highlights concerns the full picture is complex. By understanding these trends we can better navigate the changes ahead.