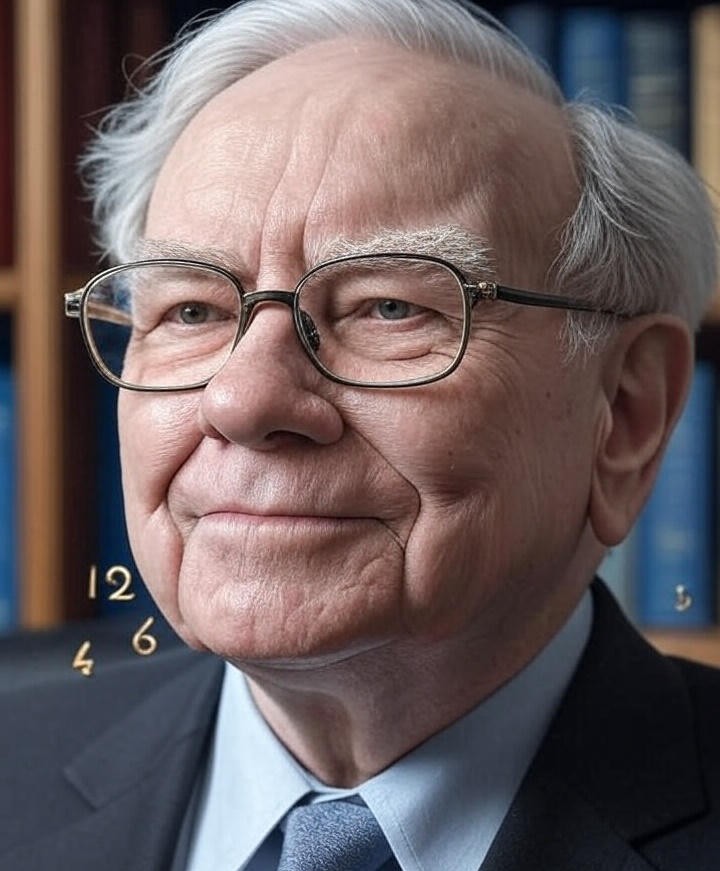

Warren Buffett is one of the most successful investors in the world. Known as the “Oracle of Omaha” Buffett has built his fortune by following smart, simple and time-tested principles. While he does not invest in mutual funds himself his advice is very helpful for those who do.

If you are a mutual fund investor here are seven golden rules inspired by Warren Buffett that can help you invest wisely and grow your wealth over time.

1. Invest for the Long Term

One of Warren Buffett’s most famous quotes is:

“Our favorite holding period is forever.”

This means you should buy mutual funds with the idea of keeping them for many years not just for a few months. Don’t try to time the market or sell when prices fall. Stay invested. Over time, markets tend to go up and the longer you stay invested the more you benefit from compounding.

Tip: Choose mutual funds with a strong long-term track record and stay invested through ups and downs.

2. Don’t Try to Predict the Market

Buffett believes that trying to guess what the market will do next is a waste of time. He once said:

“The only value of stock forecasters is to make fortune-tellers look good.”

Many investors get influenced by experts who predict market crashes or rallies. But no one can accurately predict short-term market movements. Instead of trying to time the market focus on your long-term goals.

Tip: Stick to a regular investing plan like a SIP (Systematic Investment Plan) and ignore market noise.

3. Be Fearful When Others Are Greedy, and Greedy When Others Are Fearful

This is one of Buffett’s most famous rules. When markets are booming many investors get greedy and start investing more without thinking. On the other hand when markets crash people panic and sell at low prices.

Buffett says you should do the opposite. Market crashes are often good times to invest more while overheated markets may need caution.

Tip: Don’t follow the crowd. Use market dips as an opportunity to buy quality mutual funds at lower prices.

4. Keep It Simple

Buffett advises investors to stick with what they understand. He avoids complex or trendy investments and prefers businesses that are easy to understand. The same rule applies to mutual funds.

Don’t invest in too many types of funds or try to chase returns with sector-specific or exotic funds. Keep your portfolio simple with a mix of good-quality equity and debt mutual funds.

Tip: Start with basic mutual funds like large-cap equity funds, index funds and short-term debt funds. Simpler funds are easier to manage and usually less risky.

5. Focus on Costs

Buffett always stresses the importance of keeping costs low. High fees can eat into your returns over time. In the mutual fund world this means paying attention to expense ratios—the annual fee charged by the fund.

Lower-cost funds like index funds or direct mutual fund plans often perform just as well as higher-cost ones especially over the long term.

Tip: Compare expense ratios before investing. Prefer direct plans over regular plans as they have no commission and give higher returns.

6. Know What You’re Investing In

Buffett does deep research before buying any business. He says:

“Never invest in a business you cannot understand.”

The same logic applies to mutual funds. Don’t blindly follow advice or invest in a fund just because it gave high returns last year. Understand what the fund invests in, its risk level and if it matches your goals.

Tip: Read the fund factsheet or consult a trusted advisor to ensure you understand the fund’s objective and portfolio.

7. Stay Calm During Market Crashes

Markets will always have ups and downs. Buffett has lived through many market crashes and never panicked. He sees market dips as part of the journey.

If you are investing in mutual funds especially equity funds there will be times when your portfolio goes down. It’s natural. The key is to stay calm and not sell in fear.

Tip: Avoid checking your portfolio every day. Trust the process and give your investments time to grow.

Final Thoughts: Patience Pays Off

Warren Buffett’s approach to investing is based on patience, discipline and common sense. These qualities are especially important for mutual fund investors.

You don’t need to be a financial expert to grow your wealth. Just follow these seven rules:

- Invest for the long term

- Ignore short-term predictions

- Don’t follow the crowd

- Keep things simple

- Watch the fees

- Understand your funds

- Stay calm in market crashes

By applying these Buffett-inspired principles you can make better investment decisions reduce stress and give yourself a better chance of building wealth over time.

Remember the goal is not to get rich quick. It’s to get rich slow and steady—the Warren Buffett way.